Tax Relief Malaysia 2018

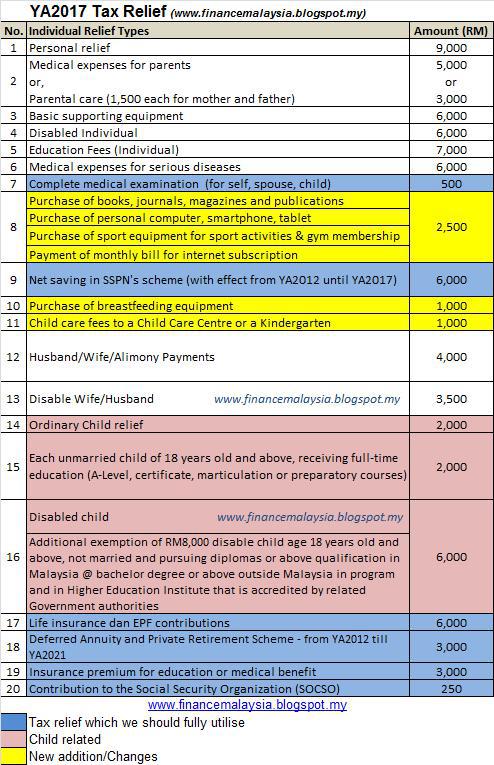

The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too.

Tax relief malaysia 2018. This relief is applicable for year assessment 2013 and 2015 only. However any amount that is withdrawn after your first deposit in 2018 is not counted. From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia.

Below is the summary of all tax reliefs available. Effective ya 2017 if a spouse has income from foreign sources or overseas which is not subject to tax in malaysia and the spouse is elected to be a combined assessment the taxpaying spouse is not qualified to claim this spouse s relief. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Income that is attributable to. Refer to this list of the income tax relief 2018 malaysia.

To help make things a little clearer we run through the list of all items eligible for tax relief with explanations for some of the more confusing entries. This voluntary disclosure can be made at the nearest irbm office commencing from 3rd november 2018 until 30th september 2019. This special program is part of the government s efforts in tax reformation.

Medical expenses for parents. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. Tax filing season has begun in malaysia and the task of trying to save money through claiming tax relief and rebates can be confusing.

Amount rm 1. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. It should be calculated as the total deposit in the year 2018 minus total withdrawal in the year 2018.

2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. All prices in malaysian ringgit rm myr all price above will subject to malaysia service tax at 6 commencing 1 september 2018. If you have deposited money into your sspn account in 2018 then this amount can be claimed in your e be form as well.